The Sickness That Has Struck UnitedHealth; It’s Worse Than You Think.

- David Abam

- May 30, 2025

- 18 min read

Introduction

When looking at a company that is so big but incredibly embattled with a multitude of controversies, it is either a sign of recent mismanagement of the company from a “few rogue employees,” or more likely, it is a sign of deep and longstanding cultural rot whereby profit at all costs is the driver not the need to deliver services to the customers. It comes about from constant pressure from Wall Street (or shareholders) to deliver growth in returns, even when market saturation has been reached. It forces management to change strategic thinking from research and development to cost-cutting and always more returns per quarter, every quarter. Eventually, the cracks that such an unsustainable system delivers become public and quite scandalous, too. Some cracks do not make headlines, but some companies and their subsequent consequences become so pronounced that they cannot help but make headlines. Every year, there is a company that makes the front pages for the worst reasons, some years there are more than one, and every year it is the job of each public company’s CEO and management to not be amongst those companies. In 2024, it was Boeing when the door blew off mid-flight and the entire fiasco surrounding that, and this year it is UnitedHealth.

Here at RIAE, we have covered the controversies that surround UnitedHealth in bits and pieces, usually dedicating them to the major headlines column; however, seeing that the stock is at historic lows, I have decided to really explore the company and whether or not we would be adding it to my portfolio at its current rate, furthermore, by such an exploration it allows you as the reader to make an informed decision, whatever that decision may be without it being construed as financial advice.

In today’s analysis, we will be exploring the beginnings and rise of the Behemoth that is UnitedHealth. We would then take a sneak peek behind the four main pillars that make up the UnitedHealth group; insurance, pharmacy, care delivery, and data analytics, showing the organisational chart of the group and its subsidiaries. We would then discuss its current controversies, which include the decrepit state of the healthcare insurance system, specifically their Deny, Delay and Defend model. Which subsequently led to the assassination of their CEO and the incredible public support that the accused Luigi Mangione has backfired on United Health. I would then discuss the abrupt resignation of their CEO, and what that tends to mean in the world of business. I’d also discuss the cyber attack that leaked personal health data of nearly half of the population of America. I would then discuss the current multiple federal investigations that have been brought against the company.

I would then discuss the fact that it may not be peculiar to this company, but the culture imbedded in the entire financial markets as seen in the two despicable law suits that shareholders have brought against the company. I would follow up by discussing what may come next for UnitedHealth; breakup, buyout, collapse or reinvention, and how likely each of those options are.

I then would explore the bearish arguments against buying the stock at historical lows. Following that with exploring the bullish arguments in support of buying the dip. In each of the arguments I would discuss ethical considerations, weighing up the moral arguments of owning the stock against a more cynical view and conclude with what I would eventually do in terms of purchasing the stock.

Early Beginnings And Rise of UnitedHealth

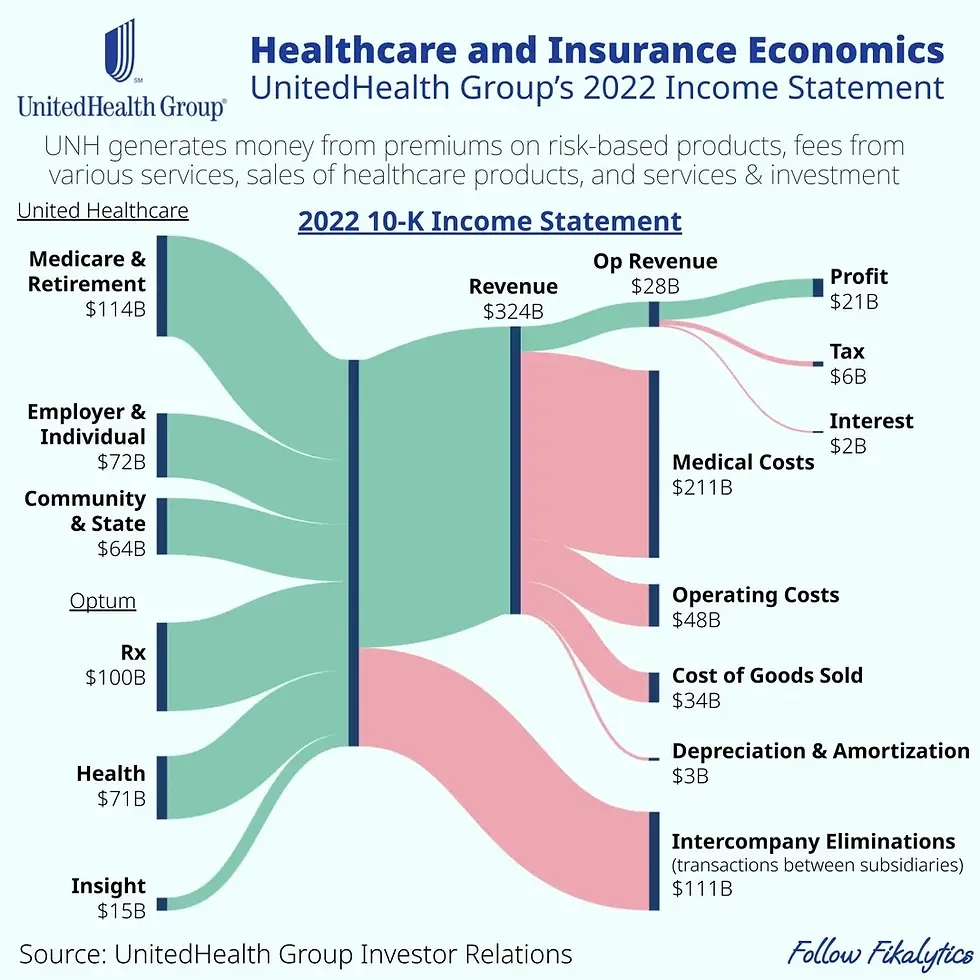

UnitedHealth started modestly in 1974 in Minnesota as Charter Med, it originally processed claims for doctors at the Hennepin County Medical Society but quickly evolved into a new kind of healthcare enterprise, one that would not just pay for care but own, operate, and control it. Over the next five decades, the company pioneered a strategy of vertical integration: acquiring not just insurance plans, but pharmacies, clinics, surgical centers, and even data analytics firms and has an estimated 439,000 employees. It earned $372bn in revenue in 2023, and is associated with one in 10 doctors in the U.S..

One can argue that their rapid expansion happened when they pivoted from just providing healthcare but the financialisation of the healthcare system itself. As such, they deployed multiple tactics of the private equity industry, focusing on vertical integration and an upward extraction of even more money from those they are supposed to care for. This includes vicious and unsafe cost-cutting measures at the patient's expense. All this has made UnitedHealth to become the second biggest company in the healthcare space in all of America.

The Four Pillars Of The UnitedHealth Empire.

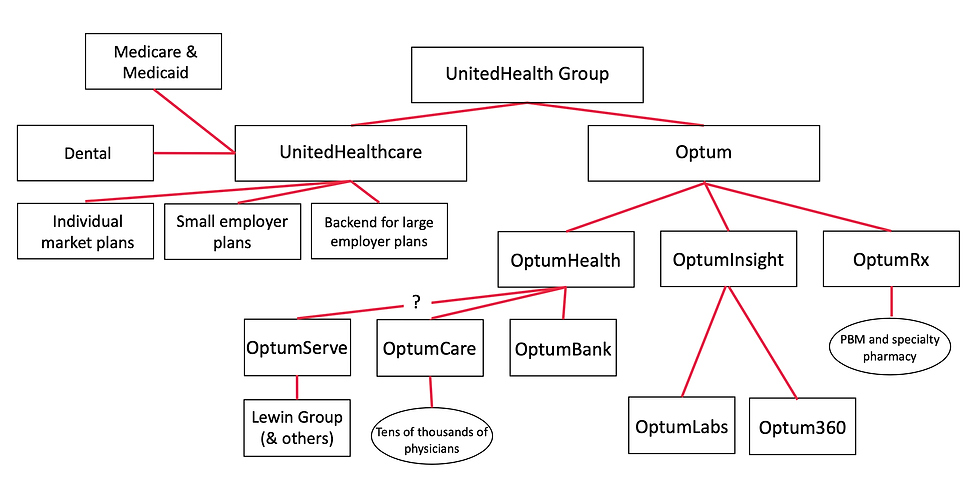

Through its two key arms, UnitedHealthcare (insurance) and Optum (care services, pharmacy, and data), the company became a giant in every corner of U.S. healthcare. Through a multitude of acquisitions, subsidiaries (about 2200), a complex web, creating a value extraction chain. UnitedHealth.

Insurance

Pharmacy

Healthcare Delivery

Data Analytics.

Insurance: It is the biggest receiver and supplier of Medicare &medicaid insurance, which is the American government paying insurance for those who do not make enough to qualify and pay for their own individual health benefits. They also provide insurance for individuals whose workplace doesn’t provide one. They also do comprehensive health insurance plans for employers to provide to their employees. Health insurance companies, such as UnitedHealth Group, foot the bill for numerous surgeries and treatments costing tens of thousands of dollars each. So, how can this be a good business? The reason is that the healthy customers are essentially paying for the sick ones. Take, for example, appendicitis. Five to nine people out of 100 will get appendicitis at some point in their lives, and many of those will need an appendectomy. The average annual individual health insurance cost was about $5,250 in 2022, and the surgery drastically ranges from $1,800 to $82,000; hence, the people who didn't need the surgery, the other 90%–95 %, cover the ones who do.

Healthcare: In its push for vertical integration, it owns a suite of urgent care centres, and it operates its own clinics and surgery centres. It also has a host of medical specialists, from nurses to surgeons, who are under their insurance coverage. It also owns and operates multiple aged care and disabled care homes. Beyond that, UnitedHealth Group's other products and services range from healthcare equipment and tools to consulting and technology, among many others. These are often delivered via consultants, direct sales, or wholesale agents. Products generated $34.4 billion in revenues for 2021, while services brought in $24.6 billion in revenues

Pharmacy: In America, there is this thing called a PBM (Pharmacy Benefits Manager), which is a third-party administrator of prescription drug programs for commercial health plans, self-insured employer plans, Medicare plans, etc. The role of pharmacy benefit managers includes managing formularies, maintaining a pharmacy network, setting up rebate payments to pharmacies, processing prescription drug claims, providing mail-order services, and managing drug use. PBMs play a role as the middlemen between pharmacies, drug manufacturers, wholesalers, and health insurance plan companies. Optum Rx manages pharmacy benefits, negotiates with drug manufacturers, operates home delivery pharmacies, and offers programs to control specialty drug costs and promote medication adherence. As of 2023, PBMs managed pharmacy benefits for 275 million Americans, and the three largest PBMs in the US, CVS Caremark, Cigna Express Scripts, and UnitedHealth Group’s Optum Rx, make up about 80% of the market share, covering about 270 million people with a market of almost $600 billion in 2024.

Data Analytics: OptumInsight monetizes through the sale of its analytics and consultancy services to health care providers, payers, and government agencies. This segment focuses on data, analytics, and technology-enabled services for the healthcare industry. It provides solutions for revenue cycle management, data analytics, consulting, and software to enhance efficiency and decision-making for healthcare organizations. Last year, Optum Insight sales were $18.8 billion, accounting for just 3% of total revenues. However, it garnered $3.6 billion in EBITDA, contributing an estimated 9% of the company’s total EBITDA.

UnitedHealth’s Current Controversies

The peculiar thing is UnitedHealth didn’t unravel overnight. But a series of damning events — some tragic, others systemic — have peeled back the carefully managed corporate image and revealed a business under siege.

Delay, Deny, Defend:

Insurance companies, as stated before, make money by having the healthy pay for the sick. It isn’t necessarily about how much money it brings in in insurance premiums, but how much it keeps by naturally or artificially reducing the amount paid out in insurance claims. Ideally, when you pay for insurance and are paying to be made whole in the event of an accident, however, UnitedHealth and other health insurance companies in the industry, with the help of consultants, developed a Triple D model: Delay, Deny, Defend. This means that the company will delay paying out insurance claims as long as possible, leaving the customer in a dire financial position, often ensuring their customer service representatives stick exclusively to an unhelpful script. If that doesn’t work, the company would just deny the claim in bulk, often using AI to deny as many claims as possible, claims that have already been paid for via insurance premiums. Finally, suppose the customer still doesn’t go away. In that case, they switch to the third D, often offering an insulting fraction as a settlement to the claimant that barely covers the out-of-pocket expenses incurred; this offer is non-negotiable. If that offer isn’t accepted, they just use their considerable resources to defend themselves in court, often extending the cases as long as possible until the claimant is unable to continue the suit due to fact that they are already spent a considerable amount of money paying for the healthcare needed and the legal fees, in some cases it is the claimants life savings being wiped out. These tactics aren't just bureaucratic hiccups. They're deeply embedded practices that many claim are designed to frustrate patients and providers alike. As one expert noted in a viral video: “It’s not about efficiency. It’s about creating barriers so patients give up before getting the care they need.” When an organization is structured around making healthcare harder to access, one has to question not only its business model but its place in a society that values health and human dignity.

The Assassination Of Their CEO:

Understandably, doing this to even 1% of the 200+ million customers they insure would mean that over 2 million people have been on the receiving end of such a ruthless system and also have negative emotions towards their insurance companies. At the scale at which UnitedHealth denied claims, that means that over 64 million patients had their claims denied. This all boiled up in December of 2024, when there was a targeted assassination of the then CEO Brian Thompson outside his hotel in New York. It was reported that this was a targeted assassination as the bullet shell casings had the words Delay, Deny, Defend etched into them. What makes this much worse for UnitedHealth is the fact that the suspect accused of the crime, Luigi Mangione, is objectively attractive, coupled with the fact that even though they may not agree with the majority of the population agree that a message had to be sent to the insurance industry execs. This has culminated in the falling of not only the company's perception in the court of public opinion but also a fall in their share price. People also truly believe that due to the rushed and haphazard nature of the murder investigation, the police have the wrong guy, and because of the pressure from industry lobbyists, they are trying to gain a conviction as quickly as possible. This has spurred an outpouring of support for Mr Mangione in words and financially, as they have completely hit the GoFundMe target raised to pay for his legal defence.

Cyber Attack:

About a year ago, UnitedHealth Group, the U.S. health-insurance giant, was targeted in one of the largest ransomware attacks ever. On February 21, 2024, its systems were infected with ransomware, rendering the platform inaccessible. The incident wreaked havoc on the U.S. healthcare system, leaving many patients to shoulder the financial burden of medical expenses as insurance claims couldn’t be processed quickly. Healthcare providers were forced to process bills manually. The massive cyberattack on Change Healthcare last year may have compromised the data of about 190 million people — more than half the U.S. population, according to an update from its parent company, UnitedHealth. A group called AlphV, also known as Blackcat, claimed responsibility for the incident. UnitedHealth CEO Andrew Witty later confirmed the company paid a $22 million ransom in Bitcoin in an attempt to protect personal information after the attack.

The Abrupt Resignation Of The CEO:

On the 13th of May, we reported that the Chief Executive, Andrew Witty resigned as of Tuesday, and the company suspended its annual forecast due to surging medical costs, sending shares plunging nearly 18% to a four-year low. Andrew Witty stepped down from leading UnitedHealth for unspecified “personal reasons,” the company said. Stephen J. Hemsley, who served as chief executive from 2006 to 2017, will return to the role and remain board chairman. Witty will serve as a senior adviser to Hemsley, the company said in a news release. One possible explanation for Witty’s sudden departure is the intense regulatory and legal pressure facing UnitedHealth. In recent years, the company has been embroiled in multiple high-profile investigations, including antitrust probes into its acquisition strategies and allegations of improper Medicare Advantage billing practices. Witty, who previously served as CEO of GlaxoSmithKline and was seen as a steady hand in the pharmaceutical industry, may have struggled to navigate the increasingly hostile political and legal environment surrounding healthcare conglomerates. His exit could signal that UnitedHealth’s board is seeking a leader with a different skill set, one more adept at managing regulatory risk or reshaping the company’s public image. Ultimately, CEO resignations during periods of instability are rarely coincidental. In Witty’s case, his exit likely reflects a combination of regulatory, operational, and reputational pressures that reached a breaking point. Whether his successor can steer UnitedHealth through these headwinds, or whether the company’s troubles run too deep for any one leader to fix, remains an open question. What is clear, however, is that Witty’s sudden departure is not just a personnel change but a symptom of the larger challenges facing corporate healthcare in an era of heightened scrutiny and discontent.

The Federal Investigations:

There are three concurrent federal investigations ongoing that are looking into the corrupt and illegal practices of UnitedHealth

Illegal Nursing Home Deals: UnitedHealth has secretly paid nursing homes thousands in bonuses to help slash hospital transfers for ailing residents – part of a series of cost-cutting tactics that have saved the company millions, but at times risked residents’ health. In several cases identified by the Guardian, nursing home residents who needed immediate hospital care under the program failed to receive it after interventions from UnitedHealth staffers. At least one lived with permanent brain damage following his delayed transfer, according to a confidential nursing home incident log, recordings, and photo evidence. To put it simply, if a resident of their care home needs to visit a hospital, UnitedHealth staff would pay nurses bonuses to NOT move the residents, opting to have them treated within the care facilities instead, just so they do not have to pay for the hospital bill or the ambulance ride.

Code Status Manipulation: My few years working in the care industry introduced me to a thing called a DNR code, which means in the event that the person does become unconscious, contrary to the norm, medical professionals are specifically instructed to let the person die, or do not (attempt to) resuscitate. Without such orders, patients are in line for certain life-saving treatments that might lead to costly hospital stays. Two current and three former UnitedHealth nurse practitioners told the Guardian that UnitedHealth managers pressed nurse practitioners to persuade Medicare Advantage members to change their “code status” to DNR even when patients had clearly expressed a desire that all available treatments be used to keep them alive. Simply put, to save ever more money and generate more profits, the nurses were financially motivated to encourage at best and pressure at worst patients to change their code statuses to a DNR.

Medicare Advantage Fraud: UnitedHealth allegedly encouraged doctors to “upcode” patients, exaggerating illness severity to extract more government payments.To put it simply, if you are under the medicare advantage plan and you are covered by UnitedHealth, if you go to your doctor for a sprained ankle, that would cost the government roughly $700; however, the people at UnitedHealth will tell the government that you actually fractured your ankle, which costs the government $2100, they will give you the care for the sprained ankle and pocket the difference.

Is It Failure Of Leadership Or Pressure From Wall Street?

I just finished reading this book called “Meltdown: Scandal, Sleaze, and the Collapse of Credit Suisse.” This detailed the cultural rot and systematic failure of leadership that ended in the collapse and subsequent acquisition of the bank Credit Suisse. In the book, the author detailed the bank's role in its own demise, and how, unlike other banks, Credit Suisse was in the middle of major financial controversy, often staking its capital and reputation in various fraudulent endeavours and companies. Prominent financial frauds such as Archegos Capital, Greensill Capital, WireCard, WeWork, etc, even when other banks were involved, such as the financial crash of 2008, Credit Suisse was one of the most leveraged and posed even more risk than the other banks. He surmised that the only reason they lasted this long is merely due to the fact that they were bailed out by the Swiss government. I surmise that that is the same thing that is occurring with UnitedHealth. My position is that in order to become the darling of Wall Street, bringing ever greater returns to the shareholders, the company engaged in monopolistic practices, deployed private equity tactics, hired consultants to become even more efficient, and cut even more costs, which gave Wall Street the understanding that not only is this allowed, it is expected and thus more could even be done. In essence, if they didn't set those standards for themselves, Wall Street would not have placed a valuation on said standards which it is now expected to keep.

For example, in its Q4 2024 reports, it downplayed the effect that the assassination of its CEO would have on its operations. The lawsuit in U.S. District Court for the Southern District of New York, which seeks class action status, accuses the health insurance company of not initially adjusting its 2025 net earnings outlook to factor in how Thompson's killing would affect its operations. On Dec. 3 — the day before Thompson was shot and killed — the company issued guidance that included net earnings of $28.15 to $28.65 per share and adjusted net earnings of $29.50 to $30.00 per share, the suit notes. And on Jan. 16, it announced that it was sticking with its old forecast. The investors described that as “materially false and misleading,” pointing to the immense public scrutiny the company and the broader health insurance industry experienced in the wake of Thompson's killing. For the readers who are not lawyers, this means that in the wake of the assassination of the CEO, the public backlash and the regulatory scrutiny, UnitedHealth, to save face, reduced its aggressiveness in claims denials and delays, which would significantly impact the company's profits and thus the shareholders are suing. To simplify it even further, UnitedHealth is being sued by its shareholders for giving too much care in the wake of the CEO assassination

It gets much worse, while this is going on, another bombshell article comes out, UnitedHealth used its employees' retirement (401k) funds to defray its own costs. The latest suit, filed Wednesday in federal court in Minnesota, claims that UnitedHealth Group held on to employees’ money after they left and used it to improperly lower its own costs, the plaintiffs argue. The move is a breach of UHG’s duty to act in the best interests of its retirement plan participants—ie, the current and former workers invested in its 401(k) plan. As the suit describes it, UHG, which took in $400 billion in revenue last year, has a fairly standard corporate 401(k) plan, matching up to 6% of employees’ pay under certain conditions. However, employees forfeit the money UHG contributed to their plan if they leave before completing two years with the company. Between 2019 and 2023, UHG used $19 million in forfeited funds to reduce its own matching contributions, instead of using it to reduce administrative fees for the 401(k) accounts.

What’s Next For UnitedHealth?

I must reiterate that even though I can make an informed guesstimate as to the future of UnitedHealth, I cannot be certain as to what that future is. However, using historical examples, it could be one or more of these three options.

Collapse: There is a possibility that UnitedHealth collapses and files for bankruptcy. However, I do not think this would be the case for a few reasons. The first is that they have about $35 billion in cash reserves, which most likely would be used in a share buyback if the stock falls even further. UnitedHealth is also too big to fail, as such a failure would trigger a government-led bailout for the company, as its failure would lead to an institutionalised failure of the entire healthcare system, yes there are others who could possibly absorb the hundreds of millions of people who are to be insured under medicare but it would be better to preserve the system as is no matter how broken it is.

Breakup or Buyout: This is more likely to happen than the entire collapse of the company. The company’s vertical integration may become its Achilles’ heel. If forced to separate its insurance and care divisions, UnitedHealth would lose its core advantage and potentially become a target for a buyout by an activist investor like Eliot Capital Management or a tech giant like Amazon or CVS Health. Furthermore, should federal regulators impose significant fines, criminal charges, or force structural divestitures, UnitedHealth could lose its grip on its most profitable segments, especially Medicare Advantage and OptumRx. Hospitals and competitors are already calling for major antitrust actions.

Reinvention: With enough political maneuvering and a new PR campaign, UnitedHealth could weather the storm. It could lean into its data capabilities, reposition itself as a “health tech leader,” and ride out the controversy. After all, big corporations have come back from worse. I place this as the highest in terms of probabilities. What could happen is that they may hire an external auditor from EY, KPMG or Deloitte to conduct a thorough investigation into the company’s culture and practices, publish its findings and commit to the recommendations made by the consultants, they may also pay their media personnel to reduce the media coverage on the company and wait out the media firestorm and in a year or two after the Mangione case has reached its logical conclusion, just revert back to business as usual, but be more methodical with it.

The Bearish Case Against UnitedHealth’s Stock

I am convinced that there are still more controversies to be uncovered by the media and news outlets at best and the Federal investigations at worst. In addition, the outcome of the Luigi Mangione case is a lose-lose situation for UnitedHealth, This is because if he is convicted, the public backlash would be against United, and they lobbied the judicial system for this outcome, and if he is exonerated, then it shows that they lobbied against the wrong person, which opens them up to a countersuit for damages. Whatever the case may be, this would trigger a further decline in the share price. If the Federal Investigations come back conclusive, it would then be put through for criminal charges to be brought against the company, with a hefty fine to be paid at best and a forced divestiture and breakup to happen at worst.

There are also ethical considerations to this. But as a values-driven investor, one can't in good conscience support a company whose success appears to be built on denying care, suppressing costs through harmful incentives, and manipulating public policy. The quote that stuck with me most from the investigations was this: “UnitedHealth has made an art form of profiting from patient suffering.” That’s not just hyperbole. It’s a systemic indictment. Plus, we cannot ignore the shareholder pressure behind many of these decisions. There’s growing frustration among some investors who feel that UnitedHealth isn’t extracting enough value from its current operations. That’s a chilling thought: that the company, already accused of so much, could be pushed to go even further in squeezing profit out of a system that is already fragile and inequitable. If shareholder sentiment is calling for "more aggressive value extraction," what does that mean for patients who are already navigating a maze of delays, denials, and impersonal systems? Healthcare shouldn’t be a zero-sum game where shareholder gain comes only at the expense of patient well-being.

The Bullish Case In Support of UnitedHealth

From a purely financial standpoint, some might argue UnitedHealth stock is undervalued given its market position, cash reserves, and footprint in both insurance and health services through its Optum division. It has the size of a company that is important to the systemic bedrock of the healthcare industry of the nation; as such, it cannot be allowed to fail, and also is able to be nimble and flexible as a much smaller company would be through its Optum and OptumRx subsidiaries. In addition, it has over $34 billion to weather the public backlash, which, by the current rate of attention-grabbing headlines, would be a distant memory, particularly after the end of the Mangione trial. The share price is at a historical low, and one can purchase it as a long-term investment just to wait out the controversies, as this could be a thing of the past in a year and even more so in 30 years.

Permit me to be cynical at this point, but ethics aside, it isn’t new to have companies profiting on the backs of people suffering. Multiple companies in multiple industries profit over the suffering of others such as Debeers, who make a profit off child and slave labour in the diamond mines, or Nestle, who have child slave labours in their cocoa farms, or Nike who use sweatshops in Asia and the Pacific regions, or the cobalt industry that has absolutely upended the Congo, or Chiquita and their use of gangs as a paramilitary to enforce slave labour in their banana farms. The only difference in this case is that those who are amongst those on the receiving end of the suffering are white Americans. This, in turn a caps my sympathy for those suffering as they have, will, and will continue to profit off the suffering of others; as such, I see very little reason as to why I should not invest in this company at a historical low, particularly on the ethics of it. If I take the cynicism to its logical end, I would go as far as to say that such an investment would put me in the position to afford healthcare in the next 60-70 years by selling my stake in the company.

Conclusion: The Reckoning And What Comes Next

UnitedHealth stands at a crossroads, its empire built on vertical integration and financial engineering now buckling under the weight of its own contradictions. The assassination of its CEO, the catastrophic cyberattack, the federal investigations; all are symptoms of a deeper disease: a business model that prioritizes extraction over care, shareholders over patients, and short-term profits over systemic sustainability. The question isn’t just whether UnitedHealth’s stock is a bargain at historic lows, but whether the company, and the system it embodies, can survive its own excesses.

For investors, the calculus is fraught. The bullish case hinges on the grim reality that American healthcare is too broken to fail UnitedHealth; the bearish case warns that even giants stumble when cultural rot metastasizes into existential risk. But beyond the charts and the lawsuits, this is a moment of reckoning. Will UnitedHealth reinvent itself, or will it become another cautionary tale of corporate hubris? One thing is clear: in a world where healthcare and capitalism remain locked in uneasy coexistence, the stakes extend far beyond shareholder returns. They’re measured in lives delayed, denied, and defended against—until the system itself becomes the diagnosis.

At RIAE, we’ll be watching closely and we will be investing at these historical lows. Whether you buy, sell, or avoid this stock, the story of UnitedHealth is a mirror. And what it reflects isn’t just one company’s future, but the soul of an industry.

Comments