The Tale of Two Teslas: Tesla the Car Company vs Tesla the Brand

- David Abam

- Jul 18, 2025

- 32 min read

It is not uncommon for a company to have and maintain a strong brand image; it is even advised that they do, and some companies fiercely litigate to protect that brand image. A fun fact in relation to this is the fact that Apple has this thing called a “no villain” clause, a whispered rule that bans the bad guys from using Apple products in movies and TV shows. However, in terms of valuations of publicly traded companies, the brand image of the company would only have a significant effect if the company were to get into regulatory problems, such as the case with UnitedHealth, or face a flurry of unfortunate disasters, as was the case with Boeing. As such, you could expect short-term volatility and a significant drop in the share price. Ordinarily, a company's share price, and consequently its valuation, is determined by things including but not limited to its Fundamentals, Revenue Growth, Price-to-Earnings Ratios (P/E ratios), Free Cash Flow, Forward Guidance, etc. All the terms that you would need to know to establish my argument will be discussed later, but it is important to note that Tesla and its valuation defy these typical metrics. I posit in this essay that there are two companies that make up Tesla and its $900 billion + valuation. Tesla, the Automotive company, and Tesla the Brand, and in the likelihood of the bifurcation of the two, Tesla’s valuation would be closer to the industry standard valuation of its peers, such as Stellantis, Ford, and BMW.

An article by Fortune attempted to calculate what Tesla’s true valuation would be, i.e., Tesla without Musk. Tesla currently trades at a P/E ratio of 227 giving it a valuation of over $950 billion, for context, the 10 largest automakers outside of China, a group that encompasses Ford and GM in the U.S.; Stellantis, Mercedes-Benz, BMW, and Volkswagen in Europe; and Toyota, Hyundai, Nissan, and Suzuki in Asia, the average is 6.9; only Nissan beaks double-digits at 15.1. It calculated that using its 2024 earnings and taking into account its presence in China and gratuitously comparing it to the multiples seen by Chinese automakers, which is about 20, Tesla the automaker would be worth $84 billion. An impressive sum, but barely 10% of its current valuation.

In this 3-Act Piece, I will explore what this premise is and what it means. The First Act would deal with Tesla, the once revolutionary automotive company that disrupted the industry by leading the charge in the production of Electric Vehicles (EVs) that were comparable to its internal combustion engine (ICE) competitors. It created and profited from the demand for good and affordable electric vehicles with more capacity and better battery technology. In essence, it produced great EVs that people actually wanted to buy. I would also explore investments and breakthroughs that made it successful, such as their gigafactory, the innovations that came out of that factory in battery technology to improve range, their foray beyond just their cars, such as their breakthrough self-driving technology, the Tesla Powerwall, and their network of superchargers. All these factors and more, it can be argued, made it once worth its valuation as a car and a technology company. However, I will also discuss their unravelling, which had been brewing in the background in terms of faults in quality control, which inevitably led to numerous recalls for their vehicles. I will also discuss the double-edged sword of their opening a gigafactory in China and how they were instrumental in what is colloquially known as the Catfish Effect in China, which inevitably catalysed their own demise in the country. Beyond China, I will also explore how their refusal to continue innovating caused them to lose market share to the Chinese car brands like BYD, NIO, that is out-innovating them when it comes to battery technology, and because of government subsidies, can outcompete them on price. Furthermore, Tesla’s refusal to use more innovative technologies, such as Light Detection and Range Scanners (LiDAR), to improve their car’s self-driving capabilities beyond just a high-resolution camera, has ensured that even though they had a ten-year and 3 million driven miles lead, they have still not delivered on Full Self-Driving (FSD) ability, which has relinquished their lead to Google’s Waymo which is conducting over 100,000 rides per week and expanding. In essence, while they are still talking about providing driverless taxis even after a decade, Waymo is doing it. Finally, on Tesla, the car company, I will discuss how the end of the EV tax credit set out in the previous administration’s Inflation Reduction Act is a detrimental blow to Tesla compared to other legacy car brands, who are able to shift production between their EVs and their ICE powered vehicle models, something Tesla cannot do.

The Second Act would deal with Tesla, the Brand. I will first address and unpack why Tesla trades not like a car company but more like a tech stock and the premium that comes as a result of that. Then, I will discuss the fact that as a brand and they are in the business of broken promises. I would discuss how Elon has for over a decade made promises of Full Self-Driving (FSD), a fact that he alluded to when he said “I am the guy who cried FSD” I will also show how, although not specific to Tesla, the way Tesla does it is incredibly detrimental, making real people spend real money, sometimes up to $250,000 for things that have been announced but are yet to be delivered even up to the time of writing. I will then expand on the promises and products that are delivered and how they are such a major deviation from what was promised that they cannot but be a disappointment. I will then discuss The Elon premium, and how his cult-adjacent followers who hang on his every word have caused the valuation to balloon, beyond its status of an automotive company, into the realms of a tech company whose fundamentals are allowed to be astronomical due to the almost infinite growth potential. I will establish how the growth in its valuation is inextricably linked to the eccentricities, promises, and vision of Musk, and how it had caused positive growth and disrupted the industry. I will also explore how for a time people liked Elon Musk so much that they chose to buy Tesla, they had so much faith in his promises of FSD that they paid for the feature when making specifications to their car at the purchasing stage, these approval ratings also reflected in the share price as retail investors who were fans of Musk bought shares in Tesla, which can be argued that they were inadvertently betting on Elon and not the company. The downsides of having a person so closely tied to the image of the brand, whereby he becomes the living embodiment of the brand and whatever he does, good or bad, has direct rippling effects on the valuation of the brand. This would be explored in greater detail from little things as when Elon became engrossed with politics, and his time spent at the Department of Government Efficiency (DOGE), which had such negative repercussions to Tesla, its valuation, and its sales numbers. It is incredible how much value is erased or added to the Tesla share price whenever Elon tweets, almost as if the stocks volatility is a feature and not a bug.

The Third Act would be discussing what this means for you if you are considering investing in Tesla. My Take: DON'T! I am convinced that Tesla is an overvalued car company, an innovative one, yes, but a car company all the same. In this current state of the car industry, ICE and EVs, Chinese car makers are dominating and growing faster, and capturing more and more market share in China and around the world, even with the over 100% tariffs America has put in place on Chinese-made vehicles, they are still growing in market share. The overall EV market has been on the decline for a long time, and with the elimination of the EV tax credit, there is even less of an incentive to buy them, which would cause a further decline in its sales. Tesla sales, which have been declining every quarter for a year now, would also fall even greater due to Elon’s abysmally low approval ratings. Additionally, the decade-long head start it had to deliver on FSD and its refusal to use more innovative technology to achieve FSD has given room to be captured by a startup, Waymo, that is backed by a juggernaut, Google. Finally, should anything unfortunate happen to Musk, or if he abruptly decides to leave (or is forced out of) Tesla, which I do not believe is an impossibility, Tesla’s shares will crater, losing over 90% of its value, causing it to trade as an auto maker and not a tech company. I can concede that this would not be everyone’s thesis on a Tesla investment; however, I have to state that my investment principle, summarised in one phrase, would be “Research like a day trader, but invest for the long-term.” This may not be suitable for everyone, but, given my risk tolerance and the fact that I run a finance and business newsletter, this works for me. My portfolio, as at the time of writing, is up about 20% year to date. If you are capable of finding alpha in the volatility that is Tesla, you are the exception and not the rule. For everyone else, it is not worth it.

Act 1

Tesla the Car Company; The Rise and Stumble Of An EV Titan From Underdog to Industry Disruptor

Scene 1: Tesla The Rising Disruptor;

Tesla Motors was founded in 2003, not by Elon Musk, but by Martin Eberhard and Marc Tarpenning, two engineers with backgrounds in tech rather than automobiles. The company’s early vision was straightforward: create fast, efficient electric vehicles that could compete with traditional gasoline-powered cars. Elon Musk joined in 2004 as a major investor, contributing $6.5 million in a $7.5 million Series A round and becoming chairman of the board. He pushed out the founders and became CEO in October of 2008. Under his leadership, Tesla witnessed unprecedented levels of growth, innovation, and pioneered the EV revolution in America and around the world. This inadvertently made him the face of the EV revolution.

The accomplishments of Tesla in the EV industry are often overshadowed or forgotten due to its CEO’s antics. Tesla made 5 distinct disruptions to the automotive industry:

Battery Technology: Prior to Tesla, the market for electric vehicles was localised, and there were many issues that had to do with the current state of battery technology. To be specific, batteries at the time were too bulky and held too little power in comparison to ICE. There was a thriving hybrid vehicle market that had emerged, but those batteries were inconsequential in terms of power output. For example, the first Tesla car, which was the roadster, had a range of 244 miles (393 km) in comparison to the 436 miles (701 km) in the longest range Tesla EV today. At the time, comparable EVs had a range of 100 miles or less.

The release of the first Tesla Model S, unlike the Roadster, which carried its battery system at the back of the car, the Model S had its underneath the floor, which gave extra storage space in back and improved handling because of its low center of gravity; this battery placement was used on later Tesla models. It is crucial to highlight that this shift to moving the batteries to the bottom of the car is directly linked to the engineers’ ability to fit even more batteries and gain even more range while simultaneously improving handling. They also were able to engineer this thing called regenerative braking, which is a system that recovers the kinetic energy of a moving vehicle during braking and converts it into a usable form of energy, typically electricity, to recharge the vehicle's battery, as compared to the conventional braking that slows down the car due to friction between the brake pads and rotors.

Direct-to-Consumer Ordering: The typical purchase of a car in most countries is done through either authorised dealers, unauthorised used car lots, or through car buying websites such as Carvana. Tesla ditched the traditional dealership model. Instead, it sold directly to consumers, online or through sleek, Apple-style showrooms. This gave Tesla more control over pricing, customer experience, and data collection. Compared to other legacy automakers, Tesla’s customisation options at the time and even now were a lot less, which meant manufacturing efficiency as there were fewer variations to the cars being produced, although this meant that Tesla owners could not, at the time of factory production, make the car more personalised to them. For example, in a Rolls-Royce (a car that starts at $230,000), there are lights in the roof of the car made from luminescent fibreglass; these lights give off a constellation effect of the night’s sky, and you can personalise this constellation to be reflective of the night sky on the date and place of your birth. With other cars, you would have to go to a dealership, and some surveys found that more than three-quarters (76%) of people “don’t trust dealerships to be honest about pricing.” Even more – 86% – were concerned that dealers would add “hidden fees” to the purchase. Another 84% felt that dealers lack transparency with customers.

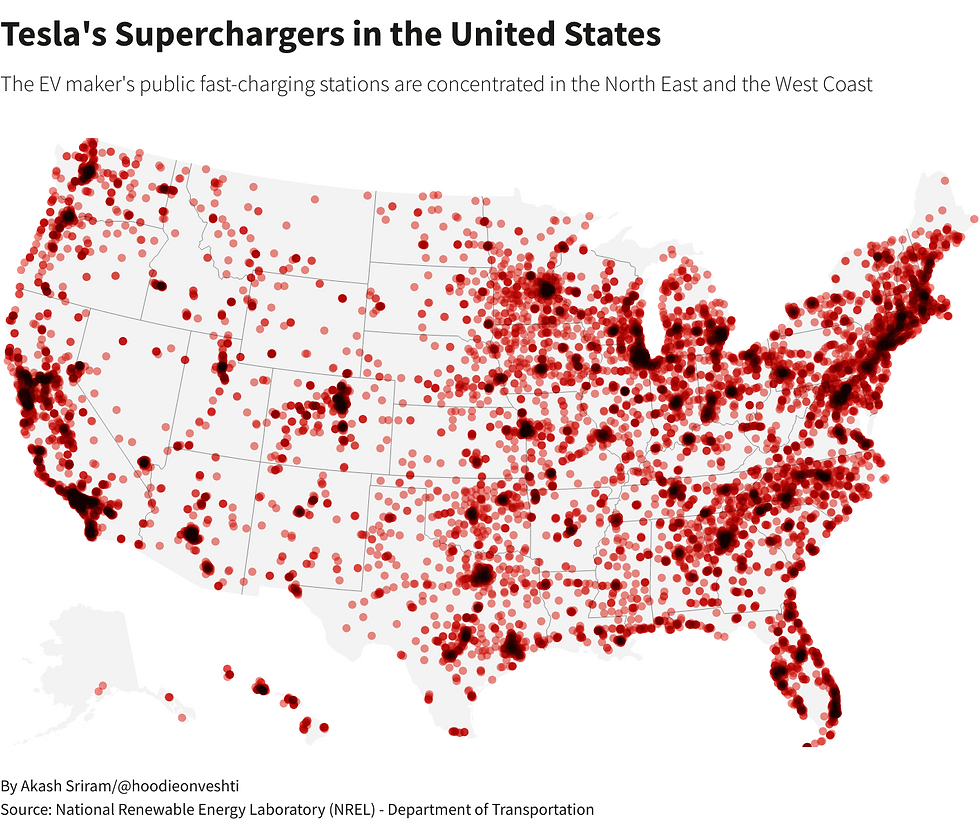

Supercharger Network: The reason why ICE cars were the preferred option to Americans, who love to road trip, is that they know that there would be a petrol (gas) station within a couple of miles, and they do not have to deal with the phenomenon of range anxiety. Range anxiety refers to the apprehension and worry experienced by EV owners about the adequacy of their vehicle’s battery charge to complete a journey or the availability of charging stations along the way. This fear stems from concerns that the EV might not be able to reach its intended destination or that there won’t be accessible charging infrastructure when needed. In order to resolve this, Tesla spent over $400 million building out their over 17,000 supercharger station capacity in the US and then opened their charging stations to non-Tesla owners to use with adapters. This, in addition to the advancements they made in both battery and charging technologies, was what triggered a disruption and a catalyst for the adoption of EVs in the US.

Semi-Autonomous Driving: Depending on where you live in the world, self-driving cars, especially self-driving Teslas, could either be an occurrence so common that it has lost its magic, or it could be so novel that it is indistinguishable from advanced science, or somewhere in the middle. Although I am yet to try a robot taxi from a company like Waymo, I have been in and driven a semi-autonomous Tesla, and the first time it happened (2019) was memorable to see how far technology had come in such a short time. Prior to the Model S, there were bits and pieces of autonomous driving but it was incredibly limited to things like lane keep assist, parking assist, braking assist, cruise control etc. Tesla made it mainstream and a viable aid to drivers everywhere. Per their own website, Tesla vehicles have collectively driven over 3.6 billion miles using their Full Self-Driving (Supervised) feature. This is an incredible feat to have achieved and it is what has set Tesla apart.

Gigafactories: The legacy car makers, in order to cut costs and boost margins, either offshored entirely their manufacturing processes to countries with cheaper skilled labour like Mexico, China, and Vietnam. Often, outsourcing the manufacturing of major components to independent contractors, and then maybe having a final assembly plant in the US. This causes fragmentation and an added layer of complexity to the supply chain and often causes major disruptions if one or more independent contractors are incapable of meeting the deadlines that they were expected. For example, if there are issues with sourcing the semiconductors (chips), as there were in 2021 [Fun Fact: there are between 1000 and 3000 chips in a typical car] it can grind the production to a halt. Tesla took a radically different approach, The Tesla Gigafactory is a large-scale manufacturing facility for electric vehicle batteries and other components, implementing lean manufacturing principles to reduce waste and improve efficiency, including the use of just-in-time (JIT) inventory management and continuous improvement practices. They also work closely with a network of suppliers to ensure that it has the materials and resources it needs to operate efficiently. All of this have helped them vertically integrate manufacturing to ensure that not only do they have components when they need them allowing them to be able to build one Tesla every 30 seconds, but also, in conjunction with their sidestepping of dealerships, they do not hold on to excess inventory. Within the same factory they’re able to innovate on battery technology. Tesla's largest Gigafactory, Gigafactory is in Texas, and has a floor area of 10 million square feet and a land area of 3.3 square miles (2,100 acres)

The gigafactory and the innovations that came about allowed them to expand beyond just the production of cars. They were diversified into things such as the aforementioned Supercharger network, the Tesla PowerWall, a home battery system that stores energy generated from solar panels or the grid, allowing homeowners to use clean energy at any time. Solar Panels for residential and commercial use, designed to generate electricity from sunlight, which works great in conjunction with the Powerwall. Solar Roofs, a roofing system that integrates solar cells, essentially replacing traditional roofing materials with a solar-generating surface. Tesla was unstoppable, every product was revolutionary, every new car was in high demand, at some point, having a Tesla was the ultimate status symbol, with the added benefit of not polluting the environment.

Scene 2: Death By A Thousand Cuts;

The problems that Tesla faced as an automaker, although none were peculiar to them, would be the ingredients of a storm that would throw the automaker into the current chaos it faces right now. As it stands now, Tesla has to fight multiple battles on multiple fronts, some of which they were directly responsible for, others were changes in macroeconomic circumstances that they have currently been unable to adapt to. All of these circumstances have caused the unraveling of the car company in terms of loss of market share, a decline in sales, and a less-than-rosy future outlook in terms of revenue

Build Quality and Reliability Issues: Tesla, the automaker, has always had issues with build quality; such issues at the start were only cosmetic and not integral to the safety of the drive. These cars were given an extended warranty and when the issue was brought up, Tesla would take the car back and resolve the issues, such as panel gaps, software issues excessive battery degradation. It became a common theme amongst YouTubers who reviewed the car to recommend that at the point in which you pick up your Tesla, you should do an even more thorough inspection to point out the flaws that you wish they would fix of the external car, and negotiate for an extension to your warranty if you can. Now, panel gaps, build quality issues, and reliability issues in general aren’t unique to Tesla; for example, the British car brand Range Rover, whose cars can go up to $300,000 depending on the specification, has a terrible reputation in terms of reliability. However, these build quality and reliability issues in the case of Tesla would be a foreshadowing of what was to come and how much worse it would be. As these issues would lead to greater recalls of their vehicles, Tesla has recalled most of its car models at one time or another, the latest one being a Jan. 5 recall of 1.6 million cars sold in China. This recall was prompted by problems with the vehicles’ Autopilot driver-assistance system and door latch controls during collisions. In fact, an analysis of car recalls from 2014 to 2023 by US automotive research firm iSeeCars shows that Tesla’s Model Y was the most recalled car in the US. Between September 2020 and November 2023, Tesla had 24 Model Y recalls, according to data from the National Highway Traffic Safety Administration (NHTSA). Tesla’s Model 3, X, and S occupy four of the top five slots in the iSeeCars survey. That survey also showed that the largest single recall of Tesla vehicles occurred in December of 2023, when it recalled 2 million vehicles in the US to install new safeguards in its Autopilot advanced driver-assistance system, after NHTSA cited safety concerns. Additionally, quality concerns remain persistent. The Cybertruck, for instance, has faced widespread scrutiny due to delivery delays, production constraints, and a massive recall in March 2025 related to its accelerator pedal. The Model Y, Tesla’s most popular vehicle, has also been the subject of software glitches and structural complaints in both the U.S. and Europe. This affects not just customer trust, but also resale value and brand perception.

The Catfish Effect: This concept originates from a classical management theory: Norwegian fishermen placed catfish, a natural predator, in sardine transport tanks, significantly reducing mortality rates by triggering the sardines’ survival instincts. By analogy, in other fields, the introduction of strong competitors often activates industry innovation dynamics. This “catfish effect” not only stimulates competition but also provides new momentum for technological development. This is what occurred with Tesla in China. Prior to opening their gigafactory in the country, its domestic automotive market had stalled on innovation and technological skills, so instead of infusing these dying companies (the sardines) with more capital, the Chinese government (the CCP) decided to introduce a foreign tech player with considerable resources to spur the local industry to innovate or die. Many car companies could not compete in such a ruthless environment, and they were eventually bought out for spare parts, but the car brands that emerged ended up taking back market share not only in China but all around the world. Market share in China, Tesla’s largest growth market, has eroded sharply, as local rivals like BYD, Xiaomi, Nio, and Li Auto continue to launch more affordable and increasingly sophisticated EVs. In Q1 2025, BYD sold nearly 320,000 battery electric vehicles, overtaking Tesla globally for the first time.

The End Of The EV Tax Credit: As of the time of writing, President Donald Trump’s signature on his so-called Big Beautiful Bill does not extend the tax credits that lowered the cost of electric vehicles. Those tax credits — worth up to $7,500 and $4,000 for purchases of new and used EVs, respectively — won’t be available after Sept. 30. Another tax break that’s ending lets dealers pass along savings on EV leases. This is a real disappointment to the EV industry as a whole. However, unlike other legacy car makers, which can just adjust their production facilities to meet demand fluctuations, in which they reduce the number of EVs being produced and focus more on their ICE counterparts, Tesla only sells EVs; there is no adjustment there. There is expected to be a considerable drop in sales in Q4 of 2025, when the tax credits officially expire, this comes as there is already a slowing demand for a multitude of reasons in Tesla, as seen in their YoY 2024 sales figures. According to Tesla’s Q2 2025 earnings, global deliveries fell 13.3% year-over-year, marking the steepest drop since the pandemic.

Noteworthy Question: If Tesla has been dethroned as the King of EVs and is being bested on price, quality, features, technological innovation, and most of all manufacturing capacity, then what else does it have as a brand that stands out from the rest of the automotive industry? Furthermore, in the broader automotive industry, which includes ICE-powered vehicles and hybrid vehicles, demand is due to slump at the end of the year due to the end of the tax credit. Unless Tesla decides to compete with the same aggression and innovation as it did in the 2010s, it is bound to lose market share revenue, and its prestige.

Act 2

Tesla the Brand: The Tech Premium and The Cult of Elon

Scene 1: Why Tesla Trades Like A Tech Stock:

As previously stated, in comparison to other legacy automotive companies in America and China, which trade between 3-20 multiples of revenue, Tesla trades at multiples (P/E ratios) of over 200 times its earnings.

I think it is important here to explain what a P/E ratio is; The Price-to-Earnings (P/E) ratio is a simple way to gauge whether a stock's price is reasonable compared to its earnings. It tells you how much investors are willing to pay for each dollar of a company's profit. A high P/E might suggest the stock is expensive, while a low P/E could indicate it's a bargain. The P/E ratio is calculated by dividing a company's stock price by its earnings per share (EPS). It essentially shows how much investors are paying for each dollar of the company's earnings. For example, if a company's stock is $50 and its EPS is $5, the P/E ratio is 10 ($50/$5). This means investors are paying $10 for every $1 of the company's earnings. A high P/E ratio often suggests that investors have high expectations for future earnings growth. A low P/E ratio might indicate that the stock is undervalued or that the company's earnings are lower. The P/E ratio is most useful when comparing companies within the same industry or comparing a company's current P/E to its historical average

The idea that Tesla is a technology company gained credibility in 2013, when its stock price shot up by 382.5% within a single year. Publications scrambled to find similarities between companies from the technology sector, which had similar growth rates, and Tesla. Online publication Slate even ran a piece that compared Tesla to Apple Inc. (AAPL) and Alphabet Inc. (GOOG) subsidiary Google. Back then, Morgan Stanley analyst Adam Jonas, who has been a Tesla bull since the company's earlier days, gave the stock a price target of $103 "at full maturation." Tesla's shares raced past that figure in May 2013, and as of this writing, are trading at $317. However, it did not happen in a vacuum; there are several points of similarity between Tesla and the tech sector. For starters, Tesla's valuation in the markets has increased despite its history of reporting losses. Several tech companies, such as Workday, Inc. (WDAY), sport high valuations despite generating losses. Tesla has also adopted the disruption credo of the tech sector. Much like other tech companies, Tesla is intent on changing existing business models as previously discussed. Tesla has been as disruptive as any other tech company; its growth, scale, innovation, and challenge of the status quo are all hallmarks of a tech company.

Although all these and much more remain true, Tesla's product reflects its roots in the capital-intensive automobile industry. In that respect, the company is unlike technology companies, which have high margins and low scaling costs. Tesla requires massive capital infusions to finance its production costs and will need to invest significant amounts to scale its operations. According to NYU professor Aswath Damodaran, the company's recent debt offering in the markets (as opposed to diluting its equity stake) was motivated by conservative bankers who wanted to mimic the auto industry's modus operandi.

Broken Promises As A Business Model:

Similar to any other tech company, Tesla and its CEO are also prone to making promises and not living up to them. There are many promises or products, often called Vapourware, that have been announced by tech companies that are never released, and even when they are released, it is such a deviation from what was announced that it ends up being a complete disappointment. Common examples include Apple's AirPower, which was a highly anticipated wireless charging mat that ultimately failed to materialise. Announced in 2017, it was intended to charge multiple Apple devices (iPhone, Apple Watch, and AirPods) simultaneously, regardless of their placement on the mat. However, development challenges, particularly with overheating and inconsistent charging, led to its cancellation in 2019. Some might even say that is the nature of the tech industry as a whole, this is because there are so many products that are teased at the start of the year at the Consumer Electronics Show (CES) from companies large and small, that never end up getting released. As such, broken promises are not specific to Tesla; however, Tesla’s seem more sinister in the manner in which it is done. They have real people pay real money on the promise and premise that what has been promised will be delivered. I will give an overview of a few broken promises that have been made:

The Tesla Roadster: A battery-powered four-seater sports car that they claimed would be able to accelerate from 0-60 mph in 1.9 seconds, which would have been quicker than any street-legal production vehicle at the time of writing. Originally set to ship in 2020 with 10,000 units, the release has been delayed multiple times. In October 2024, Elon said the Roadster would begin production in 2025. Musk said that higher-performance trim levels will be available beyond the base specifications, including a SpaceX package that would "include ~10 small rocket cold air thrusters arranged seamlessly around the car" which would allow for dramatic improvements in "acceleration, top speed, braking & cornering," and such as a 1.1 second 0–60 mph (0–97 km/h) time, and "maybe ... even allow a Tesla to fly”. All of this would be questionable ethically if it were only teased. However, at the time of writing this (July 2025), there is no new update as to it being put into production, and more importantly, 1,000 people paid $250,000 for the “Founders Series” version of the car, and numerous more put down $50,000 or more as a deposit for their vehicle. To be clear, Tesla got at least a $300 million interest-free cash injection for something that still does not exist. To put that into context, if someone had bought $250,000 worth of S&P 500 ETFs in 2017 instead of using it as a down payment, their position would be worth $635,000 today, and if the person bought only $50,000, that investment would be worth ~$130,000 today.

Tesla Cybertruck: In this case, the vehicle was eventually released after many delays; however, like I said, its release is such a major deviation from what was announced that it ends up being a great disappointment. Here is a list of 5 things promised with the Cybertruck when announced that never came to be:

A $39,900 price tag; Eventually, Tesla shipped a $120,000 Foundation Series version of the Cybertruck.

A 500-mile range; they ended up delivering only 300-350 miles of range.

Cyberquad; the Tesla quad bike it was never shipped

The Cybertruck functioning as a boat; it can only wade through 30 inches of water for a limited time

Crab walking; the ability to move diagonally, never materialised.

Full Self Driving (FSD): FSD or autonomous driving has been one thing that has been promised for over a decade, every year, either in interviews or on earnings calls, Elon would reiterate that they are only a year away from fully autonomous driving, just for it to never materialise. The problem with this is that not only did consumers make a purchase decision of the vehicle based on this promise, but they also paid an additional $8,000 to equip their car with the FSD option. Again, real people are paying real money based on unkept promises. Nothing else highlights this than a video from the YouTube Channel Upper Echelon, who compiled videos of Elon saying this over and over for 10 years.

The part that shows some sort of cognitive dissonance from what has been promised but not delivered, is the fact that there are still talks about Robot taxis and it being revolutionary. It can be revolutionary, but Tesla has lost its first-mover advantage as Waymo, the tech company backed by Google, does over 250,000 fully autonomous trips per week. It is light years ahead of Tesla, and given Tesla's refusal to adopt more different and better technological sensors and sticking to only cameras for their FSD, they may not catch up with Waymo anytime soon.

Scene 2; The Cult of Elon:

Elon Musk has always been eccentric in nature. This is not surprising as it is part of the tech founder package of Silicon Valley; however, seeing that he is the face of multiple companies, and more extricably linked to the brand of these companies, more so than any other company executive. Furthermore, his particular idiosyncrasies have amassed for him more than just a fanbase, but it is akin to a cult, this is because to some supporters, he is infallible and his word is law. This has allowed Tesla’s share price to rally with every tweet, every fireside chat, every conference he speaks at when discussing Tesla, allowing him to frame it as a tech company first and not necessarily just a car company. Regardless of the fundamentals, supporters do not necessarily invest in Tesla; they are betting on Elon. This is also because all of his other companies are not publicly listed and cannot be invested in.

The pandemic and the lockdown changed all of us one way or another and with Elon, it was the beginning of an ideal change, he became a far more frequent poster and experienced his first brushes with the world of factchecking: breezy assertions about the danger or length of the pandemic led to calls for his account to be suspended for spreading misinformation. At the same time, his daughter Vivian came out as transgender and changed her name, declaring that she no longer wanted to “be related to my biological father in any way, shape or form”. Musk himself has cited Vivian as a reason for his political shift, telling the pop psychologist Jordan Peterson that he had “lost [his] son [sic], essentially”, and concluding that his son “is dead, killed by the woke mind virus”. He turned even more right-wing wing which was a complete shift from what he had portrayed years prior. I would accept that I was a big fan of his and respected him because of his accomplishments and views; however, the switch alienated myself, and a base of his, the base of which would buy his cars. Beyond the technological advancements, people who care for the well-being of the planet and pollution tend to also be more left-leaning in their views. This change has alienated them, causing them to choose other EVs solely because of their disdain for and frustration with Elon. This was most evidently seen in his brief stint working in politics.

The DOGE-ification of Elon: As of October of 2024, Elon endorsed and more than supported but campaigned heavily for the reelection of President Trump, donating $277 million to his campaign, the most ever donated by one specific person. In which he embraced being “Dark MAGA” and when Trump was elected, not only did Tesla’s share price rise, he was put in charge of the Department of Government Efficiency (DOGE) which in principle, an idea to curb the waste, fraud, and mismanagement of government spending and to save over $3 trillion worth of waste in the government. However, the manner in which it was handled was a complete and total disaster, which greatly caused harm to Musk, the Trump administration, Trump himself, and Tesla. Whether they were personally affected/aggrieved by Musk’s tactics or disagreed with his actions and the fact that an unelected civilian has unfettered access to the President and is able to dictate/influence policy, all the gains made at the time of the election were lost. There were also many protests and riots outside Tesla showrooms and offices, which led to the destruction of a few Teslas. The Austin, Texas, company also reported a 71% drop in profits and a 9% decline in revenue for the first quarter of 2025. In addition, Musk began interfering with foreign politics in Germany, the U.K., and the rest of Europe, weighing in on and sometimes donating to far-right or more conservative parties. This was so detrimental to the polling of the administration and even the AfD in Germany that they had to explicitly distance themselves from Elon. This, in addition to his contested Nazi Salute, led to even more boycotts and protests of him and of Tesla, in Europe and around the world, compounding the car company’s woes. Tesla's share price is the only way for both institutional and retail investors to compel Elon to adjust his behaviour.

Musk’s Divided Attention: As stated, both retail and institutional investors try to compel Elon by causing the value of Tesla to rise and fall. Although this is done for different reasons, what is agreed on by both sets of investors is the fact that Elon Musk’s attention is divided, and this divided attention is what is causing the collapse of Tesla, the car company. It wasn’t too long ago that we had companies causing a ruckus about people who work from home having multiple jobs, stating that they were not committed enough to the company, and that their productivity is slacking, even when the data says something completely different. Neither was it long ago that we had the CEO of J.P. Morgan, Jamie Dimon, complaining about new graduate analysts they hire accepting job offers that are 2 years in advance, saying it makes them distracted and allows them to coast. My point here is, how come it is a problem when someone who, does the grunt work and does not have anything to do with the strategic direction for the company, to have multiple jobs but it isn’t a problem for the head of the company to somehow own and head 4 other billion-dollar companies, take up a government position and also tweet up to 100 times per day and do all of these effectively. The answer is that he is clearly doing a mediocre job in all the companies, but is rich enough to hire incredibly smart top brass to do the actual work and try to keep the machine from falling apart. This is particularly disastrous as he has gone from sleeping on Tesla factory floors to investors saying how unheard of it is that one of the biggest companies in the world doesn’t have a CEO. Good news for the company though as in April Musk said that he would be spending less time in Washington working at DOGE and more time running Tesla this is what investors want to see, more commitment to the running of Tesla and not just the running of Tesla but a fulfilment of promises prior made, such as FSD, better quality, more innovation etc. As of the time of writing, Elon and the Trump administration have had public verbal exchanges on social media; however, he still retains his government contract and does not work directly with DOGE.

Noteworthy Question: At what point do people, whether it is the board or other shareholders, look at Tesla and realise that Elon is a net liability? When does he stop being an asset? Last December, the shareholders' vote to give him a $50 billion compensation package was blocked by a federal judge. The compensation package was set up as a series of 12 milestones, each unlocking more compensation as Tesla continued to grow. Under the plan, Musk wouldn't earn a salary, but would instead receive additional Tesla shares the more the company grew. The Judge in blocking the package said “A CEO's superstar status can make even a truly independent director 'likely to be unduly deferential" and creates a "'distortion field' that interferes with board oversight.”

Act 3

Short Term Alpha vs Long Term Risks

Scene 1; Volatility As A Feature:

Tesla has some of the most dramatic volatility swings in its share price that are detached from its fundamentals and the macroeconomic environment, and attached to the whims and caprices of its founder, Elon. When Musk hints at breakthroughs in AI or comments on politics or digital infrastructure, Tesla stock can rise or fall to the tune of billions in minutes. It’s not earnings reports or vehicle specs that move markets; it’s sentiment. As a result, Tesla experiences higher-than-average volatility. In 2024, for example, Tesla had more single-day price swings above 5% than any other S&P 500 company, according to Bloomberg data. This also explains why many retail investors remain emotionally tied to Tesla. They’re not just investing in a product line; they’re investing in Musk’s vision of Tesla’s future. This tribal loyalty can buoy the stock price well above what the car company alone justifies, but it can also turn on a dime.

Depending on your risk profile, intelligence, and the information you are able to receive and synthesise, you could, in theory, find alpha in your trading of Tesla shares. In finance, alpha is a measure of the performance of an investment or a portfolio compared to a benchmark, representing the excess return above what would be expected given its level of risk. It essentially indicates how well a portfolio manager or investment strategy has performed relative to the market or a chosen benchmark, after adjusting for risk. For example, you could deduce that Elon’s public and prolific support of President Trump would cause the share price of Tesla to rise as, first Trump supporters might purchase Tesla shares/cars, and second, the close relationship between the two would lead to more favourable terms in the administration’s policies within their industry or exceptions specific to the company. With that, you could’ve purchased Tesla shares in August of 2024, where it hovered around $198 per share, and sold in January of 2025, where it reached $420 for a market-beating profit. Alternatively, you could’ve deduced that, first, the bromance between the President and Musk would come to a catastrophic end because of the sort of people they are which in turn would mean that there would be some sort of spiteful action taken against Musk and his companies, second that Musk working at DOGE would mean that he is too preoccupied to focus on Tesla causing the company to stumble in leadership, profits and earnings, and third the hate Elon is receiving online would translate to boycotts in person in the form of deliberately not choosing Tesla cars of buying bumper stickers that try to distance the buyer from the CEO. Using all of that information to short the stock in January, where it hovered around $420, and exited your short position on liberation day, where the share price fell to $231 and found alpha. As long as you are comfortable with the volatility and capable of finding alpha within the market in the short term, then Tesla could be a worthwhile investment for you.

Scene 2; Too Big A Risk Long Term:

Allow me to reiterate what was said at the beginning of this piece, my investment thesis, which is: “I research like a day trader, purchase monthly, and hold for at least 5 years before reconsidering reallocation.” Applying that thesis to Tesla, if I had bought it in January of 2021, where it hovered just under $300, and held it till June of 2025, where it hovered around $317, I would have been up a little under 6%, whereby the S&P 500 has returned nominally about 60% in that time excluding dividends. To put that into context, $10,000 spent on Tesla shares within that time frame would mean that I would have a profit of $566.7 OR 5.6% while an investment into the S&P 500 of the same $10,000 within the same time frame would give me a profit of $6,739 or 67.4%. My point is that historically, over the past 5 years, long-term holders of Tesla are barely seeing tangible value over the same time frame, and when inflation is factored in, their investments are either net zero or net negative, especially when compared to the market.

What if Elon Leaves: As seen with the compensation package that has been struck down multiple times by federal judges, and as evidenced by the alleged erratic nature of Musk, if he decides that being the CEO of Tesla no longer works for him, he might leave. Alternatively, he might also be pushed out by shareholders or the board of directors if they recognise him more as a liability than an asset. That also means that his followers and fans may leave with him. This would mean that Tesla would have no CEO, and no face of the brand, and the hype built up by said CEO leaves with him. Which leads us back to the valuation by Fortune magazine, Elon leaving means that 90% of the value of Tesla leaves with him. Members of the board and some of the company's own executives, such as the CFO of Tesla, might seem to believe that this is a real possibility, as they have collectively sold hundreds of millions of dollars worth of Tesla stock in the past few months. "Whenever insiders, including directors, are selling shares, it's not a positive signal," Jay Ritter, a professor of finance at the University of Florida, told ABC News. Seth Goldstein, an analyst at research firm Morningstar who studies the electric vehicle industry, said some of the stock sales may owe to personal financial choices made by individual officers. "While a sale doesn't necessarily mean an executive or board member feels negatively about a company's outlook, it could mean they think the stock is at a fair price or even overvalued," Goldstein said. If Tesla loses the narrative edge provided by Musk’s persona, and the brand no longer shields the car company’s flaws, a significant revaluation may follow.

As always stated, past performance is not indicative of future results, but my take is; Tesla’s past performance is an indicator of future performance. I am convinced that Tesla is an overvalued car company, an innovative one, yes, but a car company all the same. In this current state of the car industry, ICE and EVs, Chinese car makers are dominating and growing faster, and capturing more and more market share in China and around the world. Even with the over 100% tariffs America has put in place on Chinese-made vehicles, they are still growing in market share. The overall EV market has been on the decline for a long time, and with the elimination of the EV tax credit, there is even less of an incentive to buy them, which would cause a further decline in its sales. Tesla sales, which have been declining every quarter for a year now, would also fall even greater due to Elon’s abysmally low approval ratings. Additionally, the decade-long head start it had to deliver on FSD and its refusal to use more innovative technology to achieve FSD has given room to be captured by a startup, Waymo, that is backed by a juggernaut, Google. Additionally, Elon's foreign interference in other countries’ elections, and the fact that he is right leaning even though purchasers of EVs that would have purchased Teslas tend to be more liberal in their views. Finally, should anything unfortunate happen to Musk, or if he abruptly decides to leave (or is forced out of) Tesla, which I do not believe is an impossibility, Tesla’s shares will crater, losing over 90% of its value, causing it to trade as an auto maker without the hype and not a hyped up tech company. My suggestion, which is not financial advice, is to place your investible income elsewhere, possibly in an actual technology company. In short, I am Bearish on Tesla.

Conclusion:

The Tale of Two Teslas - A House Divided Against Itself

Tesla stands at a crossroads, split between its identity as an automaker struggling with quality, competition, and slowing demand, and its status as a tech-infused cult stock buoyed by Elon Musk’s mythos. This duality has allowed it to defy traditional valuation metrics, trading at 227 times earnings while legacy automakers languish in the single digits. But the cracks are widening.

Tesla’s early innovations - battery tech, direct sales, and autonomy - once justified its premium. However, today it faces a perfect storm: recalls, Chinese rivals outmaneuvering it on price and tech, and Musk’s political baggage alienating its core EV-buying demographic. The end of U.S. EV tax credits, partly triggered by Musk’s feud with Trump, will further squeeze sales. Meanwhile, Waymo’s lead in robotaxis underscores Tesla’s squandered autonomy advantage.

Tesla’s valuation isn’t about cars; it’s about faith in Musk. His tweets move markets, and his cult following treats Tesla stock as a proxy for his genius. Yet this "Elon Premium" is a double-edged sword. His rightward shift, erratic governance, and broken promises (FSD, Cybertruck, Roadster) have turned Tesla into a meme stock; volatile, sentiment-driven, and increasingly detached from reality.

The Investment Verdict: A Speculative Bet, Not a Long-Term Hold

Short-Term: Traders can exploit Musk-driven volatility, but this is gambling, not investing.

Long-Term: Without Musk, Tesla’s valuation collapses to auto-industry norms (approximately $84 billion, according to Fortune). With him, it remains shackled to his divisiveness and divided focus.

The Bottom Line: Tesla is no longer the undisputed EV leader. It is a Musk personality cult with a car problem. For investors, the choice is clear: unless you’re betting on Elon himself, your money is better parked elsewhere.

Final Thoughts: Tesla’s story is a cautionary tale of what happens when a company’s brand overshadows its product. The question isn’t if the two Teslas will reconcile; it’s how violently they’ll divorce.

Disclaimer: I must state that the information contained on this website and the resources available for download through this website are not intended as, and shall not be understood or construed as, financial advice. I am not an accountant or financial advisor, nor am I holding myself out to be, and the information contained on this website is not a substitute for financial advice from a professional who is aware of the facts and circumstances of your individual situation. I have done my best to ensure that the information provided on this website and the resources available for download are accurate and provide valuable information. Regardless of anything to the contrary, nothing available on or through this website should be understood as a recommendation that you should not consult with a financial professional to address your particular situation. Read It And Eat News Corp expressly recommends that you seek advice from a professional. Neither the Company nor any of its employees or owners shall be held liable or responsible for any errors or omissions on this website or for any damage you may suffer as a result of failing to seek competent financial advice from a professional who is familiar with your situation.

I am a Barrister and Solicitor of the Supreme Court of the Federal Republic of Nigeria with a Master’s Degree in Law, who is 6ft 5in, 130kg+ on a good day and well-versed in the art of hand-to-hand combat for self-defensive purposes.

Comments