The Economics of Snowfall

- David Abam

- 3 days ago

- 16 min read

A Deep Dive Into Who the Economic Winners and Losers are during Snowfall

"The weather outside is frightful.” Frank Sinatra I was working from home on a random weekday when I took a break to look at the view from my apartment and let my mind wander. Whilst I watched people penguin walk and cars all but crawl, I settled on an interesting thought: who benefits and suffers the most financially when it snows?

That question led me down an incredibly fascinating rabbit hole, the results of are in the pages of this essay. In chapter 1, I will identify and highlight the industries that are the direct beneficiaries of snowfall, using graphs, statistics, and figures to differentiate how some businesses revolve around snowfall while others merely pivot to be direct beneficiaries of snowfall. In chapter 2, I will then identify industries that are hardest hit economically during the snowy season. Highlighting companies and industries that are disrupted entirely during the season, and others that the season is merely an expensive inconvenience that can be priced in. In chapter 3, I will then highlight industries and a few companies that do not directly benefit from or are directly affected by snowfall itself, but are carried, or drowned, by the rippling effect in the economic tidal wave of snowfall. In chapter 4, I will then provide a macro-level forecast by synthesising available data to envision what the next decade may be like. I will also compare the net gains from cities that are adequately prepared for such weather to those that are ill-prepared. I will then conclude by reiterating how much of an economic windfall that snowfall is, to the tune of tens of billions of dollars.

Chapter 1: Snowfall’s Windfall The Direct Winter Economy “Christmas has come and gone, but the snow is still here.” Unknown As someone who grew up in Sub-Saharan Africa, where the lowest possible temperature is 12 degrees (Celsius), the concept of snow was something you only saw on TV. As such, it doesn’t occur to you how much you have to layer up just to keep warm, nor does it occur to you, especially at the age of 12, that there are economic benefits of snow. However, this all changed the first time I saw snow, inside a mega mall in Dubai. As such, it is only right that when discussing the direct beneficiaries of snowfall, I start with;

The Skiing Industry: This industry is globally worth $16 billion, with analysts forecasting it to reach $21.2 billion by 2032, with the US alone generating approximately $5.2 billion in annual revenue, supporting over 65 million skier visits per season. This revenue calculation focuses on skiing alone and not the entire Winter Tourism industry. As such things the multi-billion-dollar industry primarily focuses on skiing clothing and gear alone. In this industry, Snow depth and season length are the primary revenue drivers. Resorts typically require a minimum base of 30 inches to operate profitably, and incremental snowfall of 10 inches correlates with a 5–7 percent increase in visitation. Poor snowfall years reduce visitation by up to 40 percent in some regions, disproportionately impacting small and mid-sized resorts. During the warm 2011–2012 season, eastern U.S. ski resorts experienced visitation declines of up to 40 percent, forcing several smaller operators out of business.

There is data in company filings to support this, not mere anecdotes. For example, Amer Sports [$AS], a sports equipment designer and manufacturer that produces equipment for skiing, under the category for skiing (Outdoor Performance), reported that for the Asia Pacific region, sales rose over $150 million year-on-year. An increase that can arguably be attributed to the concurrent rise in the amount of snowfall in the skiing regions within those countries, which primed a sudden boom in China skiing activity. The Winter Tourism Industry: The global winter adventure tourism market size was valued at $320 billion in 2025, and the global winter adventure travel market is expected to reach $680 billion by 2035, growing at a compound annual growth rate of 7.9% during the forecast period. The industry reported revenue of $300 billion in 2024 and is expected to increase to over $320 billion by 2025. Even though this industry thrives during the winter season, it isn't particularly affected by the amount of snowfall as with the prior. This is because hotels, resorts, holiday planners, and holidayers tend to focus on activities that can be done indoors, and even the outdoor activities are not beholden to the depth of snow, such as Arctic Expeditions.

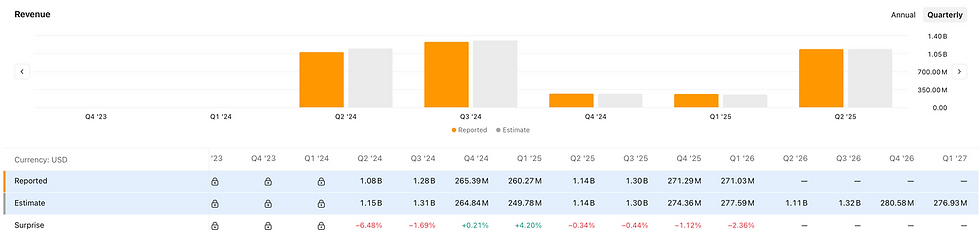

What I found particularly fascinating is the fact that this industry thrives the most when other countries are in the middle of the summer season. For example, Vail Resorts [$MTN], a $4 billion titan in the winter resorts and adventure space, revenues show that both the estimated and reported revenues for Q4 and Q1 of each financial year are, on average, a mere 21% of those in Q2 and Q3. In fact, within the colder months, the company operates at a loss.

Snow Removal and De-Icing Industry: The industry size was valued at $82.73 billion in 2024, and is forecasted to reach approximately $129.89 billion by 2032. Commercial and municipal snow removal represents an $18–$22 billion annual market in the United States, employing over 350,000 seasonal workers. Snow removal is a common snow and ice control tool used to clear snow from roadways, residential driveways, runways, and other similar locations throughout the winter to keep roads open to the public. These vehicles are usually used to clear snow off cities, airports, retailers, and logistics hubs, which rely on plowing, de-icing chemicals, and specialized equipment to remain operational. A major factor driving demand for snow removal is the rising requirement for road maintenance in snow-prone areas. Snow removal trucks are in high demand in places across North America and Europe, including Alaska, Greenland, Switzerland, and many others. Snowfall in these countries wreaks havoc on transportation, which affects businesses and daily commutes. Cities, airports, retailers, and logistics hubs rely on plowing, de-icing chemicals, and specialized equipment to remain operational. Interestingly, profitability in this sector often favors mild winters. Seasonal contracts shift snowfall risk from clients to contractors, meaning fewer storms can produce higher margins, while extreme winters strain labor, equipment, and salt supplies. De-icing materials represent a $3.5–$4 billion market, with annual U.S. road salt usage exceeding 24 million tons.

Customer facing Retailers: Unusually cold weather can also spark panic buying as shoppers rush to prepare for potential shortages and disruptions. According to Straits Research, sales of canned soups and frozen meals can jump by as much as 30% in the days before a winter storm, while generator sales have risen by more than 50% during major snow events. Heating supplies such as firewood and space heaters often surge around 40%, and over-the-counter medication sales can climb up to 20% during severe-weather warnings. These spikes show how quickly cold weather can shift consumer priorities toward comfort and preparedness. More importantly, there is a general assumption that a severe winter automatically guarantees record-breaking numbers for apparel brands. However, reality often tells a different story based on customer psychology and perceived “ROI." When temperatures drop early (even marginally), the season "feels" long. Customers see high utility value in the purchase, knowing they will wear those new winter clothes for many weeks/months. Sales volume spikes naturally.

Pro Tip: The best time to buy summer clothes is during the middle of the winter season, and the best time to buy winter clothes is in the middle of the summer season. Chapter 2: The Cost Of The Cold The Disruption Economy

While some industries hope for and thrive in torrential snow, other industries do all they can to prepare for and mitigate against the risk and losses of excessive snowfall. These industries face major disruptions that, at best, leave them with losses only from the lack of operating that day, and at worst, leave them with compensatory liabilities to their clients.

The Airline Industry: This industry already famously operates on razor-thin margins (around 3% to 4%), whereby the ticket for seats is actually a loss leader, and it is the additional fees charged that are where their margins lie. These airlines use complicated pricing algorithms to enable them to make each flight profitable, regardless of demand or lack thereof, such as reducing the turnaround time (time between arrival and takeoff), or purposefully overbooking every flight as they expect no-shows and last-minute cancellations. As such, one can imagine how incredibly disruptive an abnormal snowstorm could be for them. Although there is no publicly available data that specifically highlights snowfall as the cause of disruptions, experts estimate that European and UK flight disruptions in 2024 generated up to €6.5 billion (£5.5 billion) in potential compensation liability, with nearly 218,000 departing European flights being eligible for compensation under the EU261 scheme. This estimate is based on conservative assumptions of 120 passengers per flight and a minimum payout of 250 euros; these assumptions do not cover the fact that some cancellations have to provide food, food vouchers, and hotel accommodations. Applying those conservative estimates to the most recent airport disruption caused by a snowstorm that happened in January 2026 at Amsterdam Schipol airport, with over 3,300 flight cancellations affecting around 300,000 passengers, these airlines could be liable for an estimated €140 million to €200 million in liability for passenger compensation and care costs for that week-long disruption. Interestingly, in America, passengers are not entitled to any further compensation for delays and cancellations; they would only be entitled to a refund.

The Logistics Industry: The movement of goods would suffer the same fate in a snowstorm as the movement of people, as long as it requires people to move the goods. As such, there will be catastrophic consequences with shipping delays; unlike airlines, where the consequences are limited to the specific flight, its customers, and the company’s finances, shipping delays, in addition to those, have globally reverberating consequences. Beyond the minor inconvenience of not having one’s fourth pair of Bluetooth headphones from Amazon delivered the next day, there are real financial consequences to having snowfall/weather-related disruptions, such as:

The Brick & Mortar Retail Industry: During heavy snowfall, a physical store has 2 options: they could either stay closed for the day and give their staff unpaid leave, or they could open and run the risk of making no sales for that day, while still having to pay their staff for that day. Snowstorms reduce brick-and-mortar foot traffic by 30–60 percent, and restaurant revenue losses during storm days are rarely recovered. This study was done in 2019, and with the proliferation of apps, websites, and platforms that bring to you everything you could want/need, it can be argued that the current statistics could be even more dire for the retailers, particularly those who aren’t under a franchise. As such, in addition to the lost sales, the business still has to pay salaries, rent, and other bills that occur for operating on that day.

Chapter 3: The Ripple Effect Indirect/Secondary Beneficiaries "A rising tide lifts all boats.” John F. Kennedy

The thing about snowfall is that for many industries, it is a windfall season for so many industries that happen to be at the right place at the right time. The following industries do not necessarily start out with the intent to benefit from snowfall, but when the seasons change, they seize the opportunities presented to them.

Property Repairs: Property restoration firms and contractors see predictable winter surges. Property damage from frozen pipes, roof collapses, and ice dams generates over $8–$12 billion annually in insured losses. Frozen pipe claims alone exceed $3 billion per year. Furthermore, there is a rise in the popularisation of heated driveways, particularly in more affluent neighbourhoods, and with the network effect, when one’s neighbour gets heated driveways, they would want the upgrade too, and would most likely ask for the contact details from their neighbour. Also, snowfall causes the formation of icicles and hail, all of which can cause significant property damage to things like roofs, gutters, tiles, sheds, etc. This means that during these times, as other businesses wind down, these businesses and consultants boom, and can charge much higher prices for last-minute or emergency call-outs.

Automobile Repairs and Mechanics: Auto body shops, property restoration firms, and contractors see predictable winter surges. This is because winter months experience 20% – 30% higher vehicle accident rates, as such, generating 35% – 45% of annual revenue for auto body repair shops in snow-prone regions. These accidents happen because the roads tend to freeze up and smooth out, which prohibits their tyres from gripping the road. Often, it causes an accident pile-up involving multiple cars.

The Energy Industry: It is common knowledge that when the weather gets colder, the use of indoor heating increases. What you may not be aware of is that utility companies earn up to 70% of annual residential revenue between November and March, in other words, 70% of their annual revenues are made within 40% of the year. Unfortunately, under the economic principles of supply and demand, extreme cold events spike demand, straining grids and triggering regional price spikes exceeding 200% and household budgets alike. Longer snowfall periods and much colder winters are beneficial for utility companies.

The Insurance Industry: Insurance acts as the economy’s shock absorber for snowfall risk, and in tandem, snowfall acts as a reasonable/unreasonable justification for a sharp rise in insurance premiums. Property and auto insurers experience 15%–25% percent higher claim frequency during winter months, with claim severity averaging $12,000–$16,000. Premium pricing reflects snowfall exposure; as such, homeowners in high-snowfall regions typically pay 15%–35% higher premiums. Repeated severe winters trigger multi-year premium increases and coverage adjustments, embedding snowfall risk into long-term household and business costs. Insurance companies lobby to be able to raise premiums yearly, and when those lobbies aren’t as effective, they threaten to remove coverage from those areas, which forces the state and local governments to have to cover those properties’ insurance. Often, the proportion by which the insurance companies raise their premiums is not equivalent to the rise in claims made; it is often almost double the amount, as such, the companies see and take opportunities of such a potential windfall.

The Farming Industry: The farming industry tends not to have much activity during the snowy season; as such, it would be interesting to note that it, too, is an unintended beneficiary during the same season. Farmers, in preparation for this, till the ground and plant crops such as winter wheat and other perennial crops. This is done because when the snowfall does commence, it acts as both a natural insulator for the crops and soil against the extreme cold and winds, while simultaneously replenishing the soil moisture. Adequate snow cover can increase winter wheat yields by up to 25%, representing hundreds of millions of dollars in protected crop value. Snowpack also functions as critical water storage in western states, supporting agricultural production valued at tens of billions of dollars annually.

Chapter 4: The Look Ahead

Geographic Analysis: If snowfall is relatively predictable, in terms of severity, location, and season, it begs the question, “Why aren’t cities and municipalities adequately prepared for its arrival?” In America, NOAA, the National Oceanic and Atmospheric Administration, states that a seven-day forecast can accurately predict the weather about 80% of the time, and a five-day forecast can accurately predict the weather approximately 90% of the time. As such, cities ideally should trigger their mechanisms and systems set in place in order to weather these storms. The problem lies in the bureaucracies that inhibit cities from having those mechanisms in the first place. City/municipality/state-wide preparedness for a snowstorm does not occur 7 or 10 days before the snowstorm; it takes years of meticulous planning, which includes using all the data at their disposal to make forecasts and run stress tests on even the most unlikely of outcomes, so that when the real thing happens, they can act as swiftly as they can. An example of this happened in the state of Texas in 2021 when it suffered a major power crisis, which came about during three severe winter storms (Winter Storm Uri) sweeping across the United States. The storms triggered the worst energy infrastructure failure in the state’s history, leading to shortages of water, food, and heat. More than 4.5 million homes and businesses were left without power, some for several days. At least 246 people were killed directly or indirectly, with some estimates as high as 702 killed as a result of the crisis. Data showed that failure to winterize traditional power sources, principally natural gas infrastructure but also to a lesser extent wind turbines, had caused the grid failure, with a drop in power production from natural gas more than five times greater than that from wind turbines. The crisis drew much attention to the state's lack of preparedness for such storms, and to a report from U.S. federal regulators ten years earlier that had warned Texas that its power plants would fail in sufficiently cold conditions. Damages due to the cold wave and winter storm were estimated to be at least $26.5 billion. Not one to miss on the opportunity to make money off a crisis, some energy firms made billions in profits, while others went bankrupt, due to some firms being able to pass extremely high wholesale prices ($9,000/MWh, typically $50/MWh) on to consumers, while others could not, with this price being allegedly held at the $9,000 cap by ERCOT for two days longer than necessary, creating $16 billion in unnecessary charges.

While others prepare to fail by failing to prepare, some are capable of enacting policies that directly tackle and prepare for the incoming snowstorms. Following criticisms of its poor response to a deadly blizzard in 2022, Buffalo implemented a "revamped snow-fighting plan.” This was tested in January of 2026, when they had a winter storm that poured nearly a foot of snow across Western New York State. The city's Department of Public Works deployed crews around the clock starting Sunday, working alongside more than 150 private contractors to clear residential streets - a significant departure from previous years when residents complained about waiting days to see a plow. Hours after the snowfall hit the city, front loaders and dump trucks were already removing snow from residential streets in North Buffalo, with private contractors assisting city crews. The mayor said the city planned ahead by securing more than 150 outside contractors days in advance to clear secondary streets. The strategy extended throughout the city, with South Buffalo also seeing front loaders and dump trucks removing snow from residential areas. The mayor said the city has about 27 pieces of its own equipment clearing the streets, supplemented by the extensive contractor network. This surely would have cost money; however, they were able to front-load the cost and not have to deal with billions in losses as they would have prior because businesses would not be able to continue operations as the roads would have been closed, forcing them to either wait for the ice to melt or the city to respond.

What Does The Data Say: Based on publicly available data on current climate science, the outlook for snow over the next 5, 10, and 15 years points toward a consistent trend: warmer winters, shorter snow seasons, and reduced snowpack. This gradual shift will have varying economic consequences for snow-dependent industries, beneficiaries, and businesses that suffer disruption. In the next 5 years, there will be high variability in the severity of snowstorms and blizzards, but they will be in line with the trend of continual warming, and there will begin to emerge a hazard called snow drought. In the next 10 years, there will be a continued reduction in snow cover duration and depth (the snowpack), which means that the reservoirs that rely on it will be at risk of drying out, escalating the snow drought. Warmer temperatures in the wintertime would become even more prevalent. In the next 15 years, snow drought will move from a hazard to be considered to the order of the day; some regions will have their winter time shortened by over 2 weeks.

What Does the Data Mean: As snowfall patterns grow more volatile, competitive advantage will increasingly belong to organizations and regions that treat winter weather as a strategic variable rather than an uncontrollable cost. Future investment opportunities lie in forecasting analytics, infrastructure winterization, adaptive insurance products, and climate-resilient tourism and agriculture.

Opportunistic Beneficiaries of Snow:

Conclusion

So, here we are, back where we started, but I hope with a much sharper, clearer view. We began with a simple question from my window: Who wins and Who loses when it snows? What we found wasn't just a list of businesses that like or dislike the cold. We uncovered a vast, dynamic, and tens-of-billions-of-dollars-deep economic ecosystem that breathes with every winter storm.

From the ski slopes whose very existence is measured in inches of powder to the auto body shops that boom in the aftermath of a slippery commute, snowfall acts as a powerful economic transfer mechanism. It’s a seasonal windfall for some and a costly, disruptive tax for others. We saw how a single storm at Schiphol can trigger €200 million in airline liabilities, and how a warm winter can quietly erase 40% of a ski resort’s visitation. But the most crucial insight isn't about today's balance sheet. It’s about the future. The data is clear: our winters are warming, our snow seasons are shortening, and the reliable rhythms of this "white economy" are becoming more volatile. The competitive advantage will no longer go to those who simply hope for snow, but to those who strategically adapt—the cities like Buffalo that invest in resilience, the resorts that diversify, and the businesses that innovate for a less predictable climate.

Ultimately, the economics of snowfall teach us that weather is never just weather. It is a fundamental business input, a geopolitical variable, and a force that shapes communities and bottom lines. Whether it’s a gentle flurry or a historic blizzard, its financial ripples touch us all, proving that even the quietest fall of snow echoes with the sound of commerce.

|

Comments